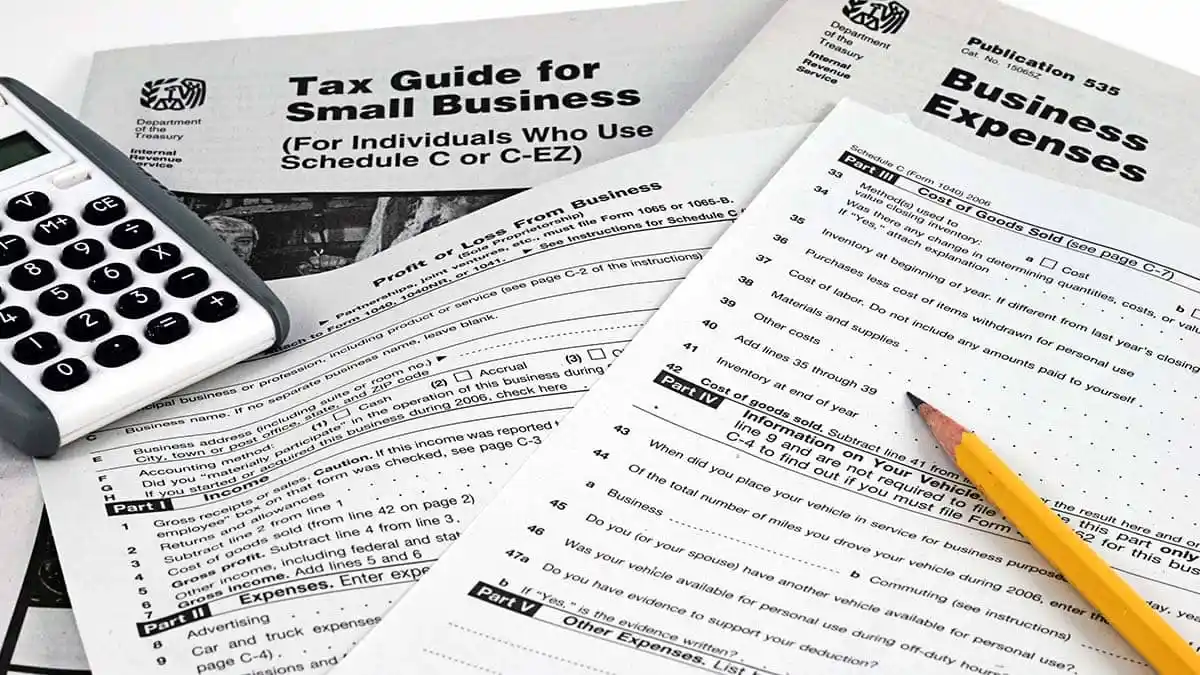

This section introduces the fundamentals of U.S. business taxation and the role of the tax preparer. Students learn the filing requirements for businesses, deadlines, and compliance obligations while exploring the differences between sole proprietorships, partnerships, corporations, S corporations, and LLCs.

- Profesor: Dr. Troy Richardson

This section covers how businesses recognize, categorize, and report income from operations, services, and sales, including cost of goods sold. Students also learn the rules for ordinary and necessary business expenses, depreciation, amortization, and other deductions that reduce taxable income, with emphasis on accurate recordkeeping and compliance.

- Profesor: Dr. Troy Richardson

This section explains how different entities—sole proprietorships, partnerships, corporations, and S corporations—report income, deductions, and distributions on their respective tax returns. Students also explore key business credits, industry-specific provisions, and special tax rules designed to reduce liability and encourage compliance.

- Profesor: Dr. Troy Richardson

This section introduces payroll tax responsibilities, including Social Security, Medicare, FUTA, and federal income tax withholding. Students also learn the rules for reporting with Forms W-2 and 1099, as well as employer deposit requirements.

- Profesor: Dr. Troy Richardson

This section highlights the use of modern tax software, electronic filing requirements, and secure data management for business returns. Students also complete practice cases that simulate real-world tax preparation, reinforcing accuracy, compliance, and professional confidence in preparing business returns.

- Profesor: Dr. Troy Richardson